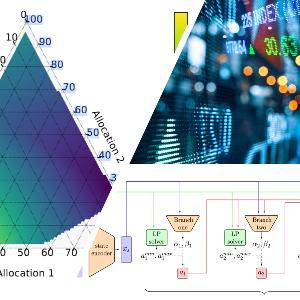

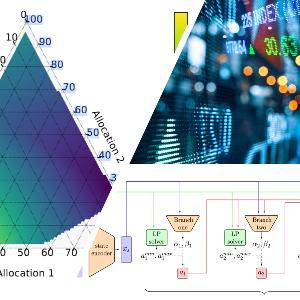

Portfolio Optimization and Resource Allocation

Sequential allocation tasks dynamically reallocate resources to a discrete set of targets. Portfolio optimization is an important application assigning financial resources to assets.

Sequential allocation tasks dynamically reallocate resources to a discrete set of targets. Portfolio optimization is an important application assigning financial resources to assets.

Our research is centered around reinforcement learning methods which a capable to handle policy function operating on a restricted polytope of continious assignments. Though we mostly evaluated our methods on the task of portfolio optimization, there are further applications like assigning computational resources to working tasks or funding to projects.